From search to purchase

Buying a house? There's a lot to think about!

Buying your own home is one of the most important decisions you will take in your life. Given this fact it is better to be well-prepared for ail the questions you may face. This document will help you with useful information, practical tips, important addresses and a list of definitions.

The opening section explains in ten steps what you will have to remember when it comes to buying a house. For example, what can you expect from an estate agent when is a valuation report necessary, how does the negotiation phase work, what are the rights and obligations of the buyer and seller, and what happens when it comes to the transfer at the office of the civil law notary. The other parts of the document will help you understand the various forms of mortgage and insurance. Good luck, and much pleasure in your new home!

The purchasing phase

Step 1

What is the maximum price I can afford for my dream home?

Once you have taken the decision to buy a house, the first thing you will want to do is start searching for your dream home as quickly as possible. You may even have already visited an estate agent. Nonetheless it is far better to first decide the price class in which you can make your search. In other words: what are the maximum housing expenses you can afford and what is the accompanying mortgage amount? To start with you should prepare an overview of your monthly income and expenditure. With these figures you can visit a mortgage advisor, who together with you will calculate the maximum mortgage amount you can borrow. If you have two incomes you can decide for yourself whether you wish to fully include both incomes for the mortgage or only part of the income. If you are expecting one income to be lost either permanently or temporarily in the near future, for example because of plans to expand your family, it is advisable to take this fact into account when calculating the mortgage.

Your income and expenditure

The points listed below will give an indication of your income and expenditure pattern. Together with the mortgage advisor using this information you can make an initial calculation of your mortgage amount.

Income:

- salary, income from business or benefit;

- additional amounts (profit sharing, holiday pay, fixed irregular hours bonus);

- second income.

Expenditures:

- current housing expenses;

- living expenses, shopping, gifts, clothing, hairdresser, etc.;

- domestic help;

- car costs (insurance, road tax, depreciation);

- study costs;

- interest and repayment obligations for loans;

- child day care;

- alimony;

- subscription costs (newspaper, magazines, clubs and associations);

- telephone, insurance, energy costs, tax.

Step 2

The search for your dream home

Once you have worked out your maximum borrowing capacity, the search can begin. At this stage it is important to write down your wishes. For example are you looking for an atmospheric pre-war home or is a new building project more appealing. How many rooms do you need and what demands will you be imposing on your living environment (distance from schools, shops, access routes, station). Of course you can first start the search by yourself. For example by looking in real estate agents' windows or by consulting friends and colleagues. In addition newspapers, home guides from estate agents and the internet are up-to-date sources of information.

Many estate agents today have their own website that you can first visit at your leisure. If you then have an idea what you are looking for, you could instruct the estate agent to undertake a house search. As soon as a house comes on the market that matches your wishes, the information will be passed on to you immediately. Remember that most estate agents do charge for a house search.

The role of the estate agent

Once you have a clear picture of what you are looking for, the next step is to visit the estate agent. Of course, you may decide to buy a home without an estate agent, but then you will miss out on his expertise and knowledge of the market. A good estate agent (such as an NVM-affiliated estate agent) knows exactly what is available and will search specifically for a house that meets your wishes. You can consult him for financial and legal advice and for drawing up the necessary contracts. Together with your estate agent you will work through the entire purchase process and he will keep your interests at the forefront. He will for example judge the asking price, the structural condition of the home, and will examine zoning plans on your behalf. In addition he will take over from you the often tense negotiations and act in your interests in negotiating the lowest possible purchase price. In this process he will remain businesslike and objective, whilst this may prove more difficult for you in such a situation. After all you are looking to buy your dream home! In other words with an estate agent by your side the entire purchasing process is a whole lot simpler and more relaxed.

The estate agent's commission

For his services the estate agent will charge a fee or commission. This commission is generally between 1.5% and 2% of the purchase amount. Certain estate agents work on a no cure no pay basis. This means that you only have to pay, if the estate agent actually succeeds in purchasing the home. Other estate agents charge a fixed rate for the home search and another rate for the purchase of a home.

The commission appears to be a considerable amount, but you get a great deal in return. With the negotiations alone you can easily earn back the fee. After all the estate agent knows exactly what attitude to take up during this phase in order to achieve the lowest possible purchase price. On top of that other services are provided such as the drawing up of contracts.

Step 3

The negotiation phase

Once you have found the home you want, the negotiations start. If you are buying a new built home, there are no negotiations with the selling party: the price is already set, in advance. If you are buying an existing home, your estate agent will issue the so-called opening bid. This bid is generally lower than the asking price in order to create sufficient space for negotiation. After all the objective is to buy the house for the most favourable price possible. Whether you succeed will depend on a number of factors. Is it a popular area, are there many other candidates, how long has the house already been on the market, how urgently does the selling party want to sell? In a tight market with high demand and low availability a house may be sold for the asking price or even more. If the market is slacker there is often more room for negotiation. Decide in advance how far you wish to go based on the extent of your financial capacity.

Although there is no reference to a contract of sale including resolutive clauses in the negotiating phase, the resolutive conditions are already relevant. These may after all influence your bid. If the seller indicates that the expected transfer date is only in a year's time, this may have consequences for the mortgage application. The results of the structural survey may also influence the level of your bid. For more information see steps 4 and 5.

Step 4

Structural survey

Even if a house looks good from the outside and inside this need not mean that it is in good condition. Faults are sometimes difficult to see and not for nothing are sometimes described as concealed faults. A structural survey during the negotiation phase is therefore a must. The structural report will identify any faults and at the same time provides a cost indication for the repairs or overdue maintenance. These costs may influence the offer you make. Your estate agent will include the results of the survey report as a resolutive condition in the contract of sale including the resolutive clauses. Should faults be discovered which will involve costly repairs you will still be able to nullify your contract of sale.

As buyer you are also subject to a so-called investigation obligation. If following the purchase an unexpected fault should be identified resulting in a conflict with the seller, a structural report must be available.

Step 5

The contract of sale including resolutive clauses

As soon as the purchase of an existing home has gone through, the estate agent will record the agreements in a contract of sale including resolutive clauses. Following receipt you have three working days reconsideration period. This is laid down in law. Within this period you can dissolve the contract of sale free of charge. Make sure that the start date of this consideration period is laid down in writing. In the contract of sale including resolutive clauses you will find the price, the transfer date, the resolutive conditions and the so-called movable properties. You need not pay any transfer tax on the agreed amount payable for these movable properties.

Once the reconsideration period has expired, you can only dissolve the contract of sale free of charge up to an agreed date, if you have included resolutive conditions in the contract and wish to make use of those conditions. You or your estate agent must then duly inform the seller in writing. The most common resolutive conditions are:

- sufficient and suitable financing

- obtaining a National Mortgage Guarantee

- obtaining a housing permit

- the result of the structural survey

- the sale of your current home before a certain date.

Also don't forget to include the list of movable properties in the contract if you have agreed with seller to leave any in the house.

Remember

If after the three days reconsideration period you wish to abandon the purchase and you have included no resolutive conditions in the contract of sale, generally speaking you must pay a penalty of 10% on the purchase amount to the selling party.

If you buy the house without an estate agent, you yourself are responsible for drawing up the contract of sale including resolutive clauses. The civil law notary can supply sample contracts. You can also obtain such documents from the Consumer Association (Consumentenbond). When drawing up the contract of sale including resolutive clauses, however professional advice is not an unnecessary luxury. After all this is a form of contract in which you are in principle bound to make the purchase.

Purchasing costs payable by the purchaser

When purchasing a home costs are automatically accrued, such as transfer tax and civil law notary's fees. These are not included in the purchase amount and must be paid by the purchaser. Together with the additional costs such as the handling fee and valuation costs these costs amount to approximately 10% of the purchase price.

No additional costs payable by the purchaser

A new built home is purchased subject to no additional costs payable by the purchaser. This means that the additional costs payable by the purchaser are already included in the price. The contractor or project developer will select the civil law notary and the costs are payable by this particular party. You will however still have to face additional costs such as the handling fee, civil law notary's fees (mortgage deed) and interest incurred during the construction phase. This includes mortgage interest during construction. In total the costs for a new built home amount to approximately 7% to 8% of the purchase amount.

The valuation report

When taking out a mortgage for an existing home, a valuation report is required. The valuation is not carried out by your own estate agent, but by an independent fellow estate agent or sworn valuer. This person will assess the value of the house and record the results in a valuation report. Not only the house itself will determine the value, but also the condition of maintenance and the neighbourhood. If you intend to modernise or renovate the home, it is wise to notify this fact to the valuer in advance. In his valuation he can then already take account of the value of the house, following the renovation work. In this way you may be able to finance the costs of the renovation in your mortgage amount as determined by the money lender, partly on the basis of the valuation report. For a valuation report generally speaking between 1.65‰ and 2‰ of the value (when sold by private treaty) is charged.

Official transfer

The official transfer of ownership takes place at the office of the civil law notary on the date agreed in the contract of sale with resolutive clauses (see also step 9). With a new built home you do not enter into a contract of sale with the seller but instead a purchase/contract agreement with the construction company or project developer. This agreement lists all your decisions on design, materials, construction time, handover and plot size. The agreement also includes a warranty and guarantee scheme. This contains your rights if the construction company were unexpectedly unable to comply with its obligations (such as the handover date). The government-approved national Home Warranty Institute (GIW) selects those construction companies that are permitted to offer their homes with a warranty. The warranty also applies to the materials, if within the warranty period your home should demonstrate shortcomings, the contractor is required to repair them.

Step 6

Down-payment on the home

To make certain of the sale the selling party has a condition laid down in the contract of sale with resolutive clauses, that you the buyer are required to make a down-payment on the home. This so-called guarantee deposit is generally the same as the penalty you are required to pay if following further consideration you wish to nullify the purchase without recourse to any of the resolutive conditions.

The guarantee deposit amounts to approximately 10% of the purchase amount. Because many people are unable to finance such a large amount from their own assets, you can also issue a written bank guarantee to be kept by the civil law notary. The majority of banks do however charge a fee for issuing such a bank guarantee.

Step 7

Suitable financing

Now you have signed the contract of sale including resolutive clauses, the time has come for definitively arranging the financing. If all is well you will already have received advice about your maximum mortgage amount, so you know that, in principle, obtaining a mortgage should not be a problem. In addition you probably signed your contract of sale subject to the resolutive condition of obtaining suitable financing. The time is therefore ripe to identify the form of mortgage that best suits your personal situation and wishes. But what kind of mortgage is that? There are so many possibilities!

Section 2 lists the most common forms of mortgage, clearly and concisely. This will enable you to take a took at which mortgage appeals most to you.

National mortgage guarantee (NHG)

Under certain conditions you may be eligible for the National Mortgage Guarantee scheme (NHG). The advantage of the NHG is that you are able to borrow at a more favourable interest rate, because the money lender will always have the loan repaid, even if you are no longer able to meet your payment obligations. This is because the Home Ownership Guarantee Fund (Stichting Waarborgfonds Eigen Woningen) will guarantee repayment of the loan (mortgage).

In return you pay a single set percentage of the mortgage amount plus administration costs. You will quickly earn back these costs thanks to the lower interest rate you pay. In addition all these costs are deductible from tax.

Advisor will mention that the mortgage requester is eligible for NHG in his initial offer for the bank. The bank will actually verify this and provide the return offer with interest rate “discount” included.

The forced-sale value of the home

If you have no personal assets or do not wish to invest them or all of them in your home, it will be necessary to fully finance the purchase amount. Whether the money lender will agree will depend on your income and the forced-sale value of the home. This is the amount the house will generate if it has to be sold by enforced sale, because the owner is no longer able to meet his financial obligations.

The forced-sale value is generally between 80% and 90% of the amount the house will generate if sold on the open market. If you have more than sufficient income, with the majority of money lenders you are able to borrow above the forced-sale value. Such a loan is of course necessary, if you wish to fully finance the home including the additional costs payable by the purchaser.

The bridging credit

If you are moving from one owner-occupier home to another, you would of course prefer to see your current home sold before you move into the new home. Unfortunately this is not always possible and then you will face double housing expenses. To financially survive this period you may request temporary financing from a money lender: a bridging credit. If your home has not yet been sold, this loan will be issued on the basis of not more than 100% of the forced-sale value of your current home. The remaining mortgage amount will be deducted. If your home has already been sold, but for example you are required to wait for the transfer of your new home, or you first wish to carry out major renovation work, the bridging credit will be based on the actual sale value. In certain situations a bridging mortgage is required, for example if the term of the bridging period is longer than a few months. In that case a mortgage deed must be drawn up by the civil law notary.

Step 8

Requesting a quotation

Thanks to collaboration with practically all money lenders, good estate agency can offer you almost every form of mortgage, good-value prices, and subject to favourable conditions. Once you have made a choice and all the details about your new home are known, the advisor can request a quotation on your behalf.

Once the money lender has received your request, based on the following criteria, he will judge whether the mortgage can be issued to you:

- are the monthly costs realistic, based on your income, assets and fixed costs;

- what is the assessed value of your intended home (the collateral);

- following consultation with the Central Credit Registration Office (BKR) in Tiel, have other debts emerged (loans, payment behaviour, default payments, etc.)

If the money lender judges your application positively, a quotation will be drawn up and sent to the mortgage advisor. The quotation will contain the precise mortgage amount, the interest percentage and the accompanying monthly costs. The quotation will remain valid for a specified term. If you wish to accept the quotation, it must be signed by you within the term laid down. In this way you will enter into an agreement with the money lender.

Step 9

At the civil law notary

The transfer of a home from one owner to another must, in law, always be settled by a civil law notary. Before the transfer takes place, the civil law notary will check how the house and any surrounding own property is recorded in the Land Registry. In this way you know precisely the extent of the property of which you will become owner. The civil law notary also handles the money transfers between the money lender, the buyer and the seller.

The Deed of transfer of title

Once the financing has been settled, and if the resolutive conditions can no longer disrupt the sale, the contract of sate including resolutive clauses is converted in to a definitive contract, and the deed of transfer of title can be drawn up by the civil law notary. In this deed the details of the buyer and seller, as well as of the home are laid down.

In addition a record is made in the deed of transfer of title of the date on which transfer will take place and – in the case of new building – when the handover will take place.

Once all these questions have been settled, you can make an appointment with the civil law notary. Both the buyer and the estate agent(s) and seller will be present, unless the seller has issued representative authority to the civil law notary.

The Mortgage deed

The second deed drawn up by the civil law notary is the mortgage deed. This for example describes the details of the mortgage, the money lender and the terms and conditions. This deed is signed by the buyer, the money lender and the civil law notary himself. In many cases the money lender will authorise an employee of the civil law notary to sign the deed.

Normally speaking a visit to the civil law notary will not last longer than an hour. The civil law notary will charge a fee for his services. Today every civil law notary has his own charges. It is often possible to reach a price agreement.

Step 10

Following the transfer: expert advice now and in the future

Congratulations! You are now the owner of your new home. You are now entering a fun but busy period because you have to plan the removal and you may wish to first redecorate or renovate the home. Once you are settled in place, you will be less and less involved in the financing of your home. After all this has been well settled. However in the future questions may occasionally arise about your mortgage. After all in the course of time your personal circumstances may change. For example because of a rise in income, new additions to the family, children undertaking study, or an inheritance. In addition interest rates and tax legislation are regularly changed. It is therefore worthwhile checking once every three years whether your mortgage still suits your personal situation.

Types of mortgage and insurance

What type of mortgage suits you?

When it comes to a mortgage, there are two main items: the monetary loan and the way in which you wish to repay that loan. On any money you borrow you will pay interest. The level of that interest will for example be dependent on the way in which you wish to make repayment and for how long you fix the interest rate. Repayments can be made in several ways. For example you can repay the entire loan at the end of the term in a single amount, or you can opt to make interim repayments. Your personal situation and wishes will determine which mortgage is the most suitable for you.

In practically all cases a house is financed with a mortgage loan. After all there are few people who are able to pay cash for their home. A mortgage is in fact nothing more and nothing less than a monetary loan with the home as the collateral. However because every financial situation is different and not everyone has the same requirements, there are hundreds of mortgage variants in the Netherlands. This may seem a lot, but most are derived from a small number of basic forms. To give you an initial idea the various mortgage types are described briefly below.

Basic mortgage types

Annuity mortgage (Annuïteitenhypotheek)

- Fixed end date.

- Repayment during term.

- Security on reduction of debt.

- Fixed gross costs and increasing net costs.

With this mortgage type you always pay a fixed monthly amount that consists of a repayment and an interest component. Because the interest component is large at the start, during this period you enjoy the maximum tax advantage. At the end of the mortgage term you pay no further interest, and the monthly costs primarily consist of your repayment. Your net monthly costs will then be higher, because the fiscal advantages will be less.

Check also Verschil lineaire en annuïteitenhypotheek?

Straight-line mortgage (Lineaire hypotheek)

- Falling gross and net monthly costs.

- Falling interest, so less tax advantage.

This is a simple type of mortgage whereby gross monthly costs are high at the start. Because you repay a fixed amount every month, the monthly costs fall constantly. This type of mortgage can be excellently combined with other mortgage types.

Savings-based mortgage (Bankspaarhypotheek)

- Build up of capital through savings insurance policy.

- No compulsory repayment during mortgage term.

- Guaranteed repayment thanks to savings insurance policy at the end of the term.

- Maximum interest relief over 30 year period.

- Choice of placing built-up capital in fiscal box 1 or box 3.

- Risk of death cover within insurance.

With this mortgage type you make no repayments during the mortgage term, paying only the interest. This means a maximum tax refund, because the interest is tax-deductible. At the same time you take out a savings insurance policy for which you pay a premium which consists of a savings and a risk component. On the savings component you receive a benefit, which is equal to the mortgage interest rate. At the end of the term all savings premiums plus the interest received will be exactly sufficient to repay your mortgage. The risk premium ensures that the mortgage can be fully or partially paid off in the event of death.

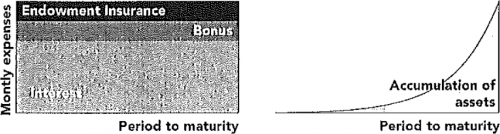

Endowment mortgage (Levenhypotheek)

- No compulsory repayment during the mortgage term.

- Mortgage is repaid at the end of the term with the capital insurance.

- Maximum interest relief over 30-year period.

- Capital is built up through capital insurance.

- Choice of placing built-up capital in fiscal box 1 or box 3.

- Risk of death cover within insurance.

With the endowment mortgage you make no repayment during the mortgage term. You save up the amount to be repaid in the form of a life insurance policy. The premium is invested. At the end of the term you can fully or partially repay the mortgage with the payment from this insurance. Also in the event of the death of you or your partner before the end date of your insurance, the mortgage debt can be fully or partially repaid. The insurance for the endowment mortgage comes in several forms: traditional life insurance, unit-linked and universal life.

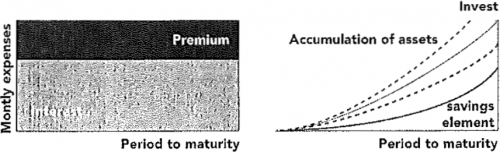

Mixed mortgage (Hybride hypotheek)

- No compulsory repayment during the mortgage term.

- Possibility of switching between saving and investment.

- Mortgage is repaid at the end of the mortgage term with the capital insurance.

- Maximum interest relief over 30-year period.

- Capital build-up through saving at the same interest percentage as the mortgage and/or through investment in one or more investment funds.

- Choice of placing built-up capital in fiscal box 1 or box 3.

- Risk of death cover within insurance.

This is a combination of a savings and investment-based mortgage. You save and/or invest via an insurance policy. You can have part of the repayment guaranteed. If you fully or partially invest your contributions, the monthly charges may fall. At the end of the mortgage term you can fully or partially repay the mortgage with the payment from the insurance. Also in the event of the death of yourself or your partner before the end date of your insurance, the mortgage debt can be fully or partially repaid.

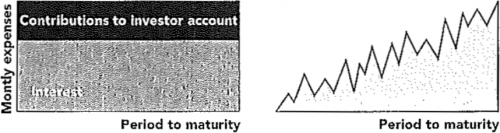

Investment-based mortgage (Beleggingshypotheek)

- No compulsory repayment during the term of the mortgage.

- One-off or periodic investment in investment funds.

- Mortgage repaid at the end of the mortgage term with the investment account.

- Maximum interest relief over 30-year period.

- Capital build-up in fiscal box 3.

With this mortgage type you invest in shares or investment funds either periodically or via an one-off investment at the start. In other words you take out no life insurance. However it is wise to take out separate insurance to cover the risk of death. Until the moment of repayment the debt remains exactly the same size, as a result of which you can enjoy the maximum tax relief. At the end of the mortgage term you fully or partially repay the mortgage with the income from your investments.

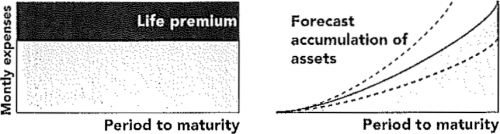

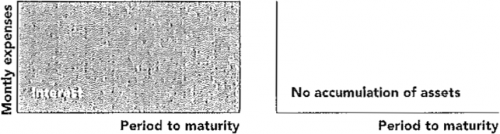

Interest-only mortgage (Aflossingsvrije hypotheek)

- You only pay mortgage interest.

- Relatively low monthly costs.

- Maximum interest relief over 30-year period.

- The loan amount cannot exceed a specified percentage of the forced-sale value.

In this mortgage type you make no repayment and pay only interest. As a result you profit from the maximum fiscal advantage and low monthly costs. This type of mortgage is often used to make use of part of the capital represented by the house. This mortgage is widely used in combination with other types of mortgage.

Insurance

Worry-free living

Before you become the proud owner of your own home, there are a number of insurance policies you can take out to ensure that in the future you can remain living in your home, and that your costly property is well protected. Fortunately you can insure yourself well against the financial consequences of damage to your home and property. Some insurance types are compulsory, whilst others are clearly advisable. Below is a list of the most important types of insurance.

Transfer security

Should you or your partner die during the period between the expiry of the resolutive conditions and the actual transfer, you are ensured that the remaining partner can take over the home.

Mortgage protection

Should you unfortunately become unemployed or incapacitated for work, with mortgage protection you will at least be certain that you can continue to pay your mortgage costs.

Sale protection

When buying a home, the development of the property value is an important item. No one can predict how property values will develop in the future. The increase in value of your own home is however clearly important if it were to be sold as a result of divorce, death, permanent disability, redundancy or company relocation. A fall in house prices could in those situations result in additional financial burdens. You can insure yourself against this risk.

Legal assistance insurance

A row with your neighbours about the placing of a fence, cutting down a tree on the boundary line between your properties, local residents who object to you fitting a dormer window; all of these are situations in which legal assistance could be useful. However the costs of such assistance can be considerable. With legal assistance insurance you are entitled to legal assistance in a wide range of disputes. For example also if you become embroiled in a conflict at work, or in a vehicle collision, where fault is difficult to determine.

Life insurance

This type of insurance is called overlijdensrisicoverzekering (ORV) in Dutch.

Till 2018 it was obligatory to have at least 20% of the mortgage to be insured if the mortgage was issued with National Mortgage Guarantee.

Non-life insurance

- Buildings insurance (opstalverzekering):

Buildings insurance is in fact the most important insurance for house owners and is a compulsory requirement from the money lender. This type of insurance means that your home can be rebuilt if damaged by fire, storm or other unexpected occurrence. - Home contents insurance (inboedelverzekering):

This type of insurance covers all damage to your home contents as a result of fire, water or burglary. The premium will depend on the value of your home contents. You can determine that value via the home content valuer. This system will also protect you against under-insurance. - Glass insurance:

Damage to all glass in your home, including double glazing and safety glass, is covered by glass insurance. - Liability insurance (aansprakelijkheidsverzekering / AVP):

A form of insurance which you cannot do without, because accidents will happen, and because claims can be considerable. Imagine that a roof tile from your house falls on your neighbour's car. Or whilst playing football, your child breaks the neighbour's kitchen window. With third party insurance you are protected against the financial consequences brought about for others by accident, by you or your family members.

A tailor-made mortgage recommendation

De Hypotheekshop

We can help you realise your dream

Buying or renovating a house has considerable financial consequences. It is worthwhile obtaining good, detailed information about the best possible financial approach. This information can best be obtained from a mortgage advisor who not only has traditional ties with the NVM estate agents, but who can also offer more than standard advice. Your search will soon bring you to our door. From De Hypotheekshop advisor you can expect advice that is perfectly tailored to your personal situation and possibilities. We take great care in our work, so that once your mortgage has been organised you have no further worries.

So why choose a hypotheekshop advisor?

For almost everybody buying their own home is the biggest purchase they will ever make. It is a major event. For that reason we go beyond simply calculating your monthly costs. We will produce a far-reaching, detailed analysis of your current situation and your future plans. We will carefully chart out all your requirements, resulting in a tailor-made mortgage recommendation. But that is not all. We will even arrange your actual mortgage too, and all the accompanying details. From requesting a quotation and valuation right through to arranging a provisional tax refund and insurance policies. Just how far we go depends on you. And once you have taken out your mortgage, we have still not finished. You are always welcome to discuss with us in the meantime whether your mortgage still matches your current circumstances, or perhaps needs altering. We will also keep you up to date on the latest mortgage news.

Independent, high-quality service

If you opt for a Hypotheekshop advisor, it is a pleasant thought that your advisor is backed up by an organisation that with approximately 185 branches is the largest independent mortgage advisor in the Netherlands. We are not affiliated to any bank or financial institution. You can be sure that once you have chosen your mortgage type, we will select the money lender that offers the most favourable interest and conditions for you. Our extra security is the Mortgage Mediation Inspection Mark. This quality mark is issued by independent experts on the basis of strict, objective quality requirements. It stands for reliable, expert and independent financial advice. If you enter an office with this quality mark on the door, you can be sure that you are dealing with a good-quality partner. All our advisers have also followed specialist training that meets the strictest requirements, and constantly undergo further in-service training. A Hypotheekshop advisor never stands still, in order to keep up with a mortgage market that is also constantly on the move.

The best conditions

The fact that De Hypotheekshop is the largest independent mortgage advisor in the Netherlands offers you one more advantage. We have been able to negotiate the most favourable conditions and interest rates from banks and other financial institutions. Indeed: we have inspired a number of money lenders to develop special mortgage products subject to the lowest interest guarantees and lowest premium guarantees. But even that was not enough for us. We ourselves have developed guarantees and insurance policies to ensure that you need have no further worries about your housing expenses, should you be overcome by some unfortunate circumstance, or your life situation changes.

Worry-free living under all circumstances

For almost everybody buying their home is the biggest purchase they will ever make. It is therefore sensible to also look into the future, taking account of specific financial risks. After all events can take place which will influence your income situation. Take for example incapacity for work, an unexpected death of you or your partner, or a pension shortfall. In these areas too, the Hypotheekshop advisor is fully informed.

Complete personal advice

We will chart out on your behalf whether you could face financial shortcomings and if so, in what situations. We will of course also advise on possible solutions. We will offer you excellent products with the best conditions. This complete personal advice is brought together in a clear report.

Drop in and see for yourself

As you can see we are pleased to go out of our way, on your behalf. So for good advice that goes far further than a standard calculation, drop in and see us at De Hypotheekshop. You can also make an appointment. For more information surf to www.hypotheekshop.nl (only in Dutch).

Glossary

A

Additional loan scheme

The excess value (the difference between the income from the sale and the remainder of the financing) released upon sale of a house must be invested in a subsequent owner-occupier house, or the mortgage interest on that amount is not deductible.

Assignment

The allocation of a home by sale, registration and auction.

B

Bank guarantee

By way of additional security the seller demands a deposit or bank guarantee. If after the expiry of the resolutive conditions, the buyer decides to not make the purchase, the seller is entitled to compensation. Generally speaking the deposit is approximately 10% of the purchase price. Instead of placing a deposit in cash, the buyer can request a bank guarantee from the money lender. This written statement from the money lender is deposited with the civil law notary. This amount is only paid if the buyer does not fulfil his obligations.

BKR

Unabbreviated: Bureau Kredietregistratie (Central Credit Registration Office).

This office registers all non-mortgage loans. These credits play a role in a mortgage request. The money lender checks with the BKR whether the mortgagor (the customer) has any such credits, and whether there has been any backlog in payment.

Bottom rate

In the mortgage quotation an interest rate is offered applicable on the day of passing of the mortgage with the civil law notary. If the interest rate in the period between quotation and the passing of the deed should fall, and subsequently once again rise, on the date of passing the deed you will be offered the lowest interest rate in the period: the bottom rate.

Bridging credit

If you have purchased another house, but your current home has not yet been sold at the moment of transfer, by means of a bridging credit you can prematurely use the excess value in the home to be sold. The conditions for the issuing of such credit differ from money lender to money lender.

Buildings insurance

Money lenders take your home as collateral for the mortgage amount to be loaned. To ensure they run no risk they oblige you to take out buildings insurance. This covers the damage to your home as a result of for example storm or fire.

C

Collateral

This is the property, such as the purchased home, on the basis of which the mortgage is issued. The collateral is a type of security for the money lender.

Commission

When buying a home you may call in an estate agent. The payment you make for this service is known as the estate agent's commission. The level of this amount is negotiable.

Consumer credit

Loans of this kind (continuous credits and personal loans) are used for consumer purposes, such as the purchase of a car, boat or caravan. Such credits are registered by the BKR in Tiel.

Contractual interest

This is the agreed interest percentage in the signed mortgage quotation.

Contract of sale including resolutive clauses

This is a contract of sale which precedes the transfer at the civil law notary. The resolutive clauses specify that the sale can only be dissolved free of charge within the reconsideration period, or in the event of resolutive conditions, such as obtaining the necessary financing.

Cooling-off period

A purchaser who is a natural person and is not acting in a business or professional capacity has a cooling-off (reconsideration) period within which to dissolve this contract. The cooling-off period lasts for three days and begins at 00:00 hours on the day following the day on which the (copy) deed signed by the parties is handed to the purchaser.

If the cooling-off period ends on a Saturday, Sunday or publicly recognised holiday, it will be extended to the first subsequent day not being a Saturday, Sunday or publicly recognised holiday.

D

Daily interest rate

The interest percentage applicable at the moment that the mortgage is executed before the civil law notary.

Deed of division (property division regulations / property division by law)

In a deed of division a building is split into different apartment rights. In this manner the apartments can be sold separately. The deed is drawn up by the civil law notary. The execution of the deed is also carried out at the offices of the civil law notary.

Deed of transfer of title

This deed (also known as transfer deed) is drawn up by the civil law notary for the sale and purchase of a home. The deed is recorded with the Land Registry. Transfer deed costs are not tax deductible.

Deductible item

Costs deductible from tax. If your own home is your main residence, all financing costs related to acquiring the mortgage for that home are deductible items. For example the handling fee, the valuation costs, the mortgage deed costs and the costs for obtaining a National Mortgage Guarantee. And of course over a maximum period of 30 years the mortgage interest is deductible.

(€15000 - €1500) × 0.42 = €5670 as tax return.

From 2014 the maximum tax return will decrease for 0.5% each year until it reaches 38% (see here or there). For 52% tax box it will last for 28 years.

As of January 2020 the mortgage interest deduction will decrease significantly: in steps of 3% per year, the mortgage interest deduction will decrease to the tax rate in the proposed first bracket of 36.93%. This means that in 2023 the tax rebate will be similar to the lowest tax rate, which will be 36.93%. During 2018, your mortgage is deductible at a maximum rate of 49.5% and in 2019 this will be 49%, if the deduction takes place in the current fourth tax bracket (for an income exceeding €67.000).

Deposit

If you purchase an existing home, the buyer may demand a certain percentage of the purchase amount as a deposit. This deposit is held by the civil law notary and remains there until the transfer has been executed by the civil law notary (usually 10% of the purchase price). The actual depositing of cash is generally replaced by a bank guarantee.

Double income mortgage

In this variant the second income is fully or partially included in calculating the maximum mortgage amount. This enables more money to be borrowed.

E

Energy label

Energy-saving measures can include a high efficiency boiler, cavity wall insulation, loft insulation, floor insulation, high efficiency boiler, high-performance glazing, heat pump, solar boiler and/or solar cells. They can also be financed with NHG.

For houses older than 10 years the presence of energy label certificate is obligatory for property transfer deed (see energielabel.nl → Is een energielabel verplicht?).

| Energy label class: | A++ | A+ | A | B | C | D | E | F | G |

|---|---|---|---|---|---|---|---|---|---|

| Score: | < 0.50 | 0.51..0.70 | 0.71..1.05 | 1.06..1.30 | 1.31..1.60 | 1.61..2.00 | 2.01..2.40 | 2.41..2.90 | > 2.90 |

See also:

- Doe de Woningtest – gives advises about what can be improved in your house

Execution

The signing of the transfer or mortgage deed with the civil law notary. After signing you are the owner of the home.

F

Final capital

The amount built up at the end of the term of a life insurance policy or investment account.

Financing costs

All costs you accrue in order to establish a loan. These costs are tax deductible.

Fixed interest period

The period in which the interest rate for the mortgage is fixed. For longer fixed interest periods the money lender generally charges a slightly higher interest rate.

Forced sale

If a home owner fails to comply with his payment obligations, the money lender may sell the home. This generally takes place in the form of an auction. In that case the house often generates less than in the case of normal sale, and sometimes less than the mortgage debt. This means that the home owner still has a remaining debt from the mortgage (which is covered by NHG if last one was issued).

Forced-sale value

The amount expected to be generated if a house is sold by forced public sale.

G

Ground lease

The ground on which a house stands or is built, can be leased. This is then not own property. The home owner in that case each year pays a fixed amount to the land owner. This amount is also known as the ground rent. It is also possible to buy off the ground lease in a single payment.

GIW

Unabbreviated: Garantie Instituut Woningbouw (National home warranty institute)

This organisation guarantees that the building fulfils the requirements of the Dutch Building Decree.

In case of a complaint the buyer first has to inform the contractor and gives him the opportunity to repair the complaint. If the buyer wants to, he can send the complaints also to the GIW-organisation.

If the contractor does not repair the complaint satisfactory, the buyer or the contractor can refer the complaint to the GIW-Arbitration.

See also A special procedure to guarantee sound isolation in dwellings.

H

Handling fee

The amount the money lender charges for taking out the mortgage. The handling fee is generally 1% of the mortgage amount. This fee is tax deductible.

Housing expenses

All costs relating to accommodation such as the mortgage costs, insurance premiums, energy charges and property tax.

Housing permit

The government wants to have the mechanism to forbid the transferring of property under certain circumstances. For example when it is needed to keep the ratio of rented/owned houses in the area, government may forbid property owner (e.g bank) to sell the house. Or for example the government may refuse to transfer the property located on ground floor to young people giving the preference to old or handicapped.

I

Interest rate averaging

If you terminate a mortgage prematurely (for example when you move home) and at the same time take out a new mortgage with the same money lender, the lender is generally willing to average the interest rate. A sort of average is then taken of the old and the new rate, depending on the terms of the fixed interest periods.

Interest rate refixing period

A period of generally one or two years in which you yourself can determine when you wish to fix the interest rate for a new fixed interest period.

Investors account

Bank account through which investment funds or shares are purchased or sold. This account is automatically opened with certain types of mortgage, whereby the capital is fully or partially built up via investments.

L

Land Registry

Amongst the information recorded at the land registry is a record of all real estate properties. Information can be obtained from the land registry about the home owner, the purchase amount at the previous sale, the surface area of the real estate property and the mortgage.

M

Maximum mortgage amount

Before you go in search of a house it is wise to have somebody calculate the maximum amount you can spend on a mortgage. For this information you could contact a Hypotheekshop advisor.

Money lender

Money lender (or financier) is the financial institution issuing the loan.

Mortgage

A monetary loan whereby the home serves as collateral for repayment.

Mortgage deed

This deed is drawn up by the civil law notary and describes the details of the mortgage, the money lender and the terms and conditions. The deed is placed in the mortgage register of the Land Registry. Mortgage deed fee is tax deductible.

Mortgage Mediation Inspection Mark Foundation

This Foundation issues the Inspection Mark (Keurmerk Hypotheek Bemiddeling) only to independent mortgage brokers who comply with strict, objective quality criteria. The Foundation also monitors compliance with the criteria imposed. De Hypotheekshop aims to ensure that all its branches hold the Inspection Mark.

Movable property

To distinct between movable and immovable property let's see the definition of immovable property:

- Something embedded in the earth, as in the case of walls or buildings.

So house itself, garage and closet in the garden are immovable properties. - Attached to what is so embedded for the permanent beneficial enjoyment of that to which it is attached.

Usually shelves on the walls, built-in kitchen appliances, fitted cupboard are immovable properties. However normal wardrobe, washing-machine are movable properties. - Things rooted in the earth, as in the case of trees and shrubs.

Thus tree in a pot is movable property.

N

NHG

Unabbreviated: Nationale Hypotheek Garantie (National Mortgage Guarantee scheme).

In the event that you become disabled or unemployed, divorced or your partner dies, you may find that you are unable to pay your mortgage. If this results in you having to sell your house, the proceeds from the sale may not be sufficient to pay of the remaining mortgage debt. In this case NHG will pay this residual debt to the mortgage lender. This is the guarantee that the money lender will be repaid all monies lent, if upon forced sale the house generates less than the value of the total mortgage debt.

If you have a mortgage with NHG and you are temporarily unable to make your mortgage payments in full as a result of unemployment, disability, divorce or death of your partner, you may be eligible for the mortgage payment Facility (Woonlastenfaciliteit, WLF). The WLF allows you to add your payment arrears to your mortgage so that you have more time to bridge a difficult period in your life. The WLF is therefore not a mortgage holiday but offers you the possibility to bridge a difficult period so that you can stay in your home.

NHG is calculated as 0.7% from mortgage amount but it's worse it. This security is rewarded by the money lender with a lower interest rate. This can be as much as -0.6%, saving you hundreds of euros every year!

The main condition to acquire it is that your income is sufficient. Furthermore the total costs (i.e. purchase price, any refurbishment costs and additional expenses such as civil-law notary costs and commission) must not exceed €350.000. You can finance the total purchase price, so including the additional costs. For these additional costs NHG charges a fixed percentage. When buying an existing house, this is 8% and the purchase price plus any refurbishment costs may not exceed €324.074 1). Thus from July 2015 is will be €245.000, from January 2016 it will be €225.000, see What new laws are coming into effect from July 1.

NHG is provided by the Homeownership Guarantee Fund (WEW). Its main aim is to responsibly promote the purchase of private property. For more information about NHG and the conditions for eligibility, surf to nhg.nl and see What is National Mortgage Guarantee? (local copy (758.49 KiB, 753 downloads)).

No additional costs payable by the purchaser (v.o.n.)

The transfer costs (transfer tax and civil law notary's fees for the title deed) are included in the purchase amount.

Notional rental value

In Dutch: eigenwoningforfait

The notional rental value is a fictitious income that the owner of a property must add to his income from work & home in Box 1. This income is also known as the own home value. The calculation is based on a percentage of the value of the home (WOZ value) per year.

€250.000 × 0.006 / 2 = €750 to your Box 1.

O

Own home value

P

Plu+s Plan(R)

Mortgage product specially developed for and by De Hypotheekshop in collaboration with a number of money lenders.

Premium deposit

The insurance company automatically collects the premiums from a blocked (savings) account. This premium deposit applies with a life insurance policy.

Provisional tax refund

In Dutch: voorlopige teruggave inkomensheffing

The owner of an owner-occupier home can submit an application to the Tax Office for a monthly refund of the estimated value before the tax return is submitted.

Purchasing costs payable by the purchaser

In Dutch: kosten koper – K.K.

When purchasing an existing home, costs are charged, such as transfer tax and civil law notaries fees. These are not included in the purchase amount and are payable by the purchaser. Together with the additional costs these amount to roughly 10% of the purchase price.

R

Real estate agent

Intermediary who mediates for the purchase and sale of real estate property.

Reconstruction value

This is the amount required to rebuild a house, for example if destroyed by fire. This value is stated in the valuation report and forms the basis for the compulsory building insurance.

Repayments

This is reducing the mortgage debt. For certain types of mortgages it is possible to do extra repayments per year without penalty (usually 10%…20% of initial mortgage). In case if current mortgage rates are higher then ones fixed by agreement, then money lender may allow to repay more then this, even the whole debt. For example if you have taken a annuity mortgage with fixed rate of 3.80% for 5 years and after 1 year the rate for rest of the period (4 years) is 3.85%, then the bank is eager to get money from you and re-lend them to another client with higher rate.

Resolutive conditions

In the contract of sale including resolutive clauses, stipulations may be contained concerning the circumstances according to which the contract can be dissolved. Examples when the sale will be dissolved:

- The financing condition: if the buyer is unable to obtain sufficient financing or acquire NHG.

- If structural investigation reports problems that need to be fixed/repaired in short term (within one year).

S

Structural survey report

A surveyor assesses the structural condition of a home. For apartments built before 1940 and for which a mortgage is applied with the National Mortgage Guarantee, such a report is compulsory. Structural report costs are tax deductible.

T

Term

Duration of the mortgage or life insurance.

Testament

A written document providing for the disposition of a person's property after death. Can be made in addition to mortgage deed at notary at the day of property transfer.

Title deed

Same as transfer deed.

Transfer tax

This tax is charged upon the transfer of an existing home and amounts to 6% of the purchase amount (unless the Dutch Government reduction is in place). Transfer tax is payable by the purchaser and is not tax deductible.

U

Under-insurance

The insured value of for example your home contents is lower than the actual value. The actual value can easily be determined using the home content valuer.

V

Valuation

The assessment of the value of the home (called marked value) by a sworn valuer or estate agent. The bank can use one of the following criteria for determining the market value:

- The purchase price of an existing property

- The purchase price of a newly built property, but this may be increased by the price of the land, building costs, additional building work (such as kitchens, bathrooms, etc.), loss of interest during the building period and the connection of the property to the utilities

- The most recent WOZ value (the value as determined by the municipality)

- The value according the valuation report and here renovations and improvements to the house may be included.

All money lenders in The Netherlands accept a valuation which is validated with the NWWI. Some money lenders require also a NWWI-validated report for non-NHG financing. Only appraisers who meet strict quality requirements may join the NWWI for their valuation reports to validate.

Valuation costs are tax deductible.

Value when sold by private treaty

This is the value of a home on the free market and is therefore also known as the free sale value.

Variable interest rate

With a variable interest rate the interest you pay will fluctuate with interest rate developments.

W

WoonRust(R)

(Housing) insurance policies of which a number are exclusively available at De Hypotheekshop.

WOZ

Unabbreviated: Wet Waardering onroerende zaken (Valuation of Immovable Property Act).

The WOZ value of your home is determined by the local municipality (use this service to determine it). This is carried out according to a valuation reference date on which the sale prices of similar homes are measured. The WOZ is used as the basis for the own home value, municipal taxes and charges from the water board. The services like WOZ Consultants, Kadasterdata will help you to check if your current WOZ is too high and if so they apply for WOZ reduction and take 25% of realized tax discount.

Useful addresses

- Royal notarial association

De Notaristelefoon (for legal questions) (between 09.00 and 14.00 hours)

0900-346 93 93 (25 cent p/min.)

0900-346 93 93 (25 cent p/min.)

- Tax office

Belastingtelefoon (Tax query line): 0800-0543 (free in the Netherlands)

"Девица не хочет лезть в Окно" – device not compatible with Windows.